The net cost of developing your own mobile wallet will be approximately around $12000-17000. We are a highly experienced team of app developers, UI/UX designers, product managers and business analysts who have experience in developing and handling numerous custom apps for clients. Being trusted mobile wallet app development company in India, Let’s Nurture can offer best-in-class mobile money transfer app solutions with cutting edge payment integration technologies. Albeit, the only way of differentiation can be on the basis of the quality of the product – its unique user experience and robust yet secure wallet app development process. Looking to develop your own mobile wallet application?Īs the mobile wallet app market is crowded globally, there are several players offering unique platforms with numerous features. Let’s Nurture is a leading mobile wallet app development company providing digital payment solutions and integration to business applications. The result is now that from the sophisticated financial markets of New York to the developing markets of Mumbai, the most revolutionary companies in fintech are mobile wallet app solutions providers. The growth in global smartphone production and increases availability of internet infrastructure has only fuelled this growth. Mobile wallets came into rise after PayPal disrupted the payments industry. They and many companies like them have given way to a specific category in payments – Mobile wallets leveraging mobile wallet app development technology offering seamless digital payment solutions. Both the companies have managed to make several billion dollars in market cap and are now counted as the biggest influencers in the world. The fact that Ecommerce is as big as the industrial revolution can be verified by looking at two of the most revolutionary companies in two different corners of the world and their industries of operations: Amazon and Alibaba. The basic functions of any Ewallet Application are: Store the Card Details: Since you connect your bank account with the e-wallet application, it stores your bank details as well as the information of the debit and credit cards that you may use for payments. Joining fees or signup fees are one-time fees merchants may be requested to pay in order to partner with an eWallet company.How Much Does It Cost to Develop a Mobile Wallet Application? Merchants looking to partner with certain eWallet companies may be charged a transaction fee or merchant discount rate of approximately 0.5 – 3.0% of every transaction made from customers using the respective eWallet. While eWallet users in Malaysia aren’t usually charged fees, this is where merchants get the short end of the stick.

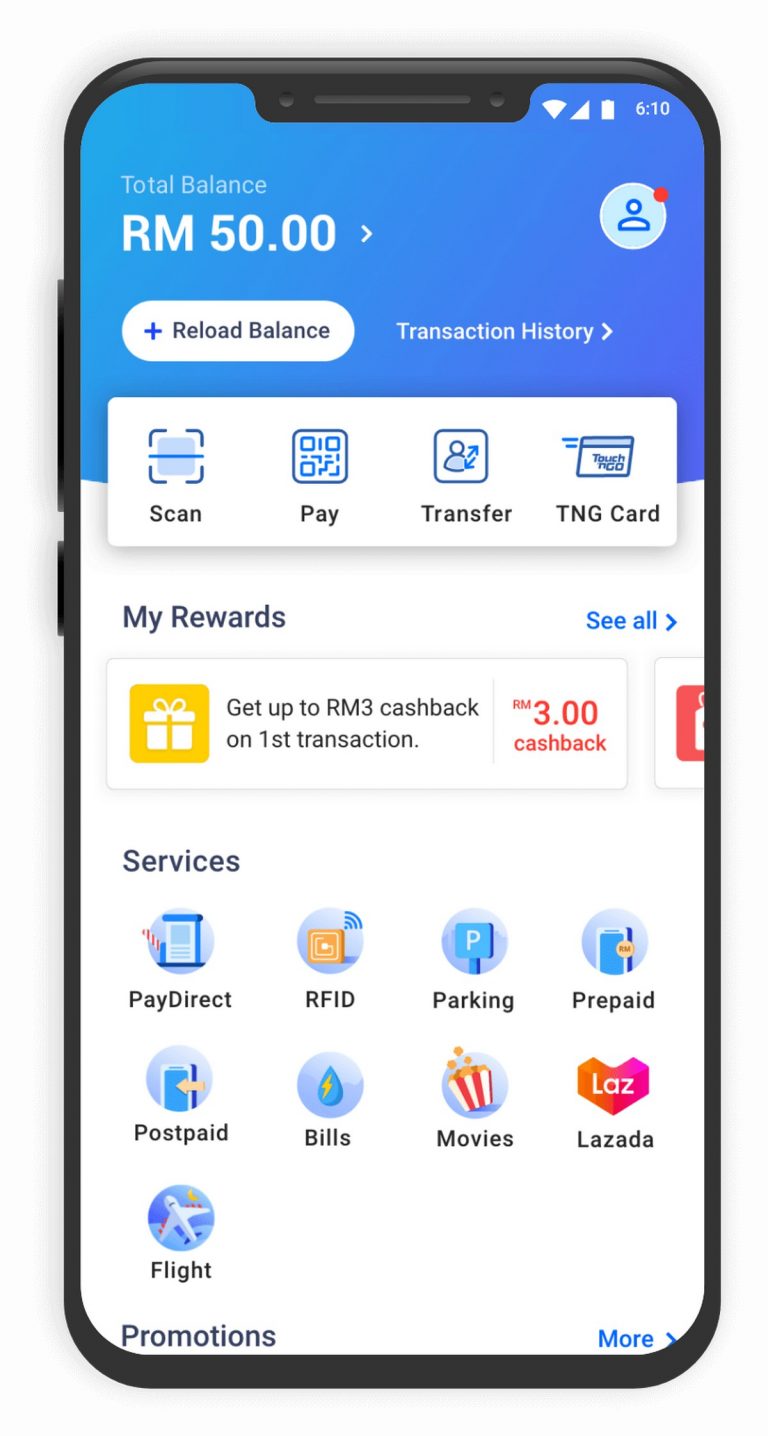

TNG eWallet also allows you to increase your maximum eWallet size from the default RM200 to RM1500 upon linking your credit/debit card, or up to RM5000 once you register as an RFID user. Instead, you might be asked to provide extra authentication of your identity (as with Boost).

EWALLET CHARGES UPGRADE

You’d be glad to know though, that most Malaysian eWallets will not charge you to upgrade your account. Premium account fees are one-time fees that you can opt for to upgrade your eWallet balance size if you find yourself in need of larger capacity. If you’re wondering why, such limits are imposed to mitigate any possible fraudulent transactions. PayPal charges between 3.5% – 4.0% depending on the currency into which the amount is converted Account upgrade feesĮarlier, we mentioned how most Malaysian eWallets will place a cap on the maximum balance you can have in your eWallet. You might not associate this with eWallets, but bigger eWallets which accept cross-border transactions will typically have this fee. As handy of a feature as it is, you may incur a fee to send money via this feature. In recent years, many eWallets have introduced the feature to perform fund transfers to other users of the same eWallet. Internal transaction fees are also known as remittance fees. These may incur separate fees from withdrawal to your bank account.

Boost refers to this as Cash-Out, and charges 2% of the Cash-Out amount (up to a maximum fee of RM2 for each request) ATM Withdrawal feesĬard-based eWallets like BigPay sometimes allow you to withdraw cash from select ATMs, similar to a debit or credit card. Transaction fees (MDR) Merchants looking to partner with certain eWallet companies may be charged a transaction fee or merchant discount rate of approximately 0.5 3.0 of every transaction made from customers using the respective eWallet. Withdrawal fees are charged when you choose to retrieve funds from your eWallet and transfer them into your bank account. Most eWallets in Malaysia don’t charge this fee, but most do have a maximum limit on the amount of funds you can store in your eWallet at any one time. Deposit fees may also be known as top up fees, and are imposed when you top up funds into your eWallet.

0 kommentar(er)

0 kommentar(er)